Contents

She is a CPA, CFE, Chair of the Illinois CPA Society Individual Tax Committee, and was recognized as one of Practice Ignition’s Top 50 women in accounting. She is the founder of Wealth Women Daily and an author. Unlike the previous levels, this one does not focus on the technical aspect of trading. Trading analysts Meet the market analyst team that will be providing you with the best trading knowledge.

I have been a trader long enough to know a thing or two about how most people think while trading the market. The Forex trading psychology of Experienced traders are quite good and they do handle their emotions well. They exactly knows when to trade the market and when it’s better not to trade.

These tips are by no means everything that a trader needs to know about trading psychology or how to improve emotional responses to the market developments. However, taking them into account can still have a significant effect on how they react to the payouts or losses and how they make trading decisions. Market conditions might change but Forex market psychology remains the same. I prefer to tell people the truth, and the truth is that having an effective and non-confusing trading strategy is very important, but it’s only one piece of the pie.

There’s no value in bringing the baggage from past trades into new trades. If you want to achieve long-term success, you need to focus on the “mental” game as much as you focus on strategy. As you embark on your trading journey, you quickly realize how important the psychological component of trading is. Avoid all possible ways that emotions can ruin your performance. We are going to list some tips which are going to help.

The reason is simple; We take hasty and irrational decisions when we are angry, depressed or greedy. A professional community centred around helping you to become a consistently profitable trader by mastering your trading psychology. The majority of traders don’t put in the work needed on their trading psychology. They never master their emotions nor understand their behaviour which leads to their failure. Do you want to know how to dominate the market and become a master in financial trading?

How Emotions Impact a Forex Trader’s Performance

Trading process becomes much easier and simpler when you are following your rules. What’s more, disciplined traders are the ones that make money in the market consistently. Yes, market tokenexus conditions change and your strategy might stop bearing fruit, but when you have your emotions in check, you can develop a strategy that fits the new conditions much more easily.

This will help you to ensure your actions align with your plan and keep your emotions in check. Psychological factors and sentiments greatly affect the performance in Forex trading and hence the results because of the dynamics of the Forex market. It really helps me to trade and especially to learn. I’m still very much a newbie and it really helps me with your teachings. When you use a strategy that has been tested enough in the past, you will be able to avoid losses more easily. With the skills, mental tools and trading methodologies we provide you, we cut down your learning curve from 5 years to just a few months.

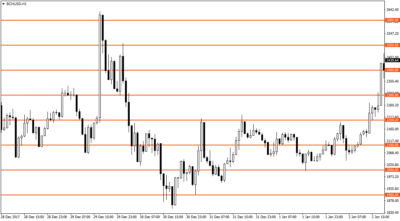

Sooner or later, the trend reverses and the greedy get caught. Overall investor sentiment frequently drives market performance in directions that are at odds with the fundamentals. I am confident that i can become a professional trader. Learn how to trade a man for all markets review forex in a fun and easy-to-understand format. This course covers a deeper understanding of Risk Management and how you can earn money from being consistent and sticking to your strategy. Chart patterns Understand how to read the charts like a pro trader.

Be Skeptical of the Obvious Trade

Traders who are better organised and who plan their actions in advance are usually more successful than those who do not. Your mindset will ultimately fusion markets review determine what you focus on, how well you learn, how you react to trades, and so on. Today, we are going to discuss some quick tips to help you…

HowToTrade.com helps traders of all levels learn how to trade the financial markets. Before you start trading, it is necessary to understand how emotions can affect your performance. Any strategic preparation you do is meaningless if you have not prepared yourself mentally or emotionally. How much higher would your trading profits be if your losses were cut in half? How much higher would they be if you only lost half as frequently?

Access to resources, knowledge and powerful methods that have a proven edge. If you use a VPN service, make sure you are connecting from the country that is authorized for fbs.com services. Update it to the latest version or try another one for a safer, more comfortable and productive trading experience. Take breaks from trading and occupy your mind with something else. Lead a healthy life with sports or at least walks and good food. All of this will help you to relax and have more strength for trading.

What is Trading Psychology?

Having control over your emotions is essential for successful trading. Start by training skills such as patience and self-control. These take practice, and it is never too late to start. Self-controlled traders are able to trade in their pre-defined rules without deviation.

Constantly increase your knowledge about trading and Forex market. Take courses, read books and articles, learn from professionals. The more you know about trading, the more psychologically sound you will feel.

- Many skills are required for trading successfully in the financial markets.

- To avoid such developement, proper risk management is essential.

- If you keep moving these values, there is no point in setting them in the first place.

- Remember, consistancy in trading is highly rewarded by the investors.

Forex Trading involves significant risk to your invested capital. Please read and ensure you fully understand our Risk Disclosure. When things do not go your way, the negativity may eventually creep up on you. If you start feeling overwhelmed and are suffering from trading fatigue, take a break. Do not succumb to the pitfall that is revenge trading. A sudden success could be an outlier event and the trader’s high is only temporary.

When Is It Okay to Trade Against The Trend?

But in a longer term, they get disappointed because after the sunshine the rain begins. The trader comes gradually to believing that no market analysis is flawless; that next trade is not always profitable. The period of euphoria ends, and trader becomes more cautious in his/her future undertakings. If you feel frustrated because you are not making money day in and day out, most likely it is not your fault. This industry is full of paradoxes, and retail traders are instructed to do exactly what they are supposed to. They start with forex or stocks because are the easiest financial products.

Therefore, it can be a good idea to sort things out with your current emotional state, develop a certain plan, be patient, and adapt to new occurrences. This way, traders tend to yield less to emotions and more to reason. Next up, let’s talk about impatience and greed in trading.

It is often overlooked or completely ignored, but it is something that every Forex trader should become good at. It is the skill of managing your own emotions and is a part of Forex trading psychology. One thing that is absolutely essential to understand is that both fear and anger are innate feelings that every single person experiences in their lives.